COVID-19 has wreaked havoc on global financial markets, causing major uncertainty and high volatility. Although the maximum impact is yet to be determined, the virus’ knock-on effects are expected to continue to have a negative impact. We examine the areas of the overall banking sector most likely to be affected, including valuation and profitability, in our Global banking M&A outlook H2 2020 report.

COVID-19 is most likely to affect the following areas:

Profitability and credit management, as well as risk management and cost of risk

In mature markets, the low-interest rate situation, along with the considerable effect of the COVID-19, is reducing core banking profitability. As a result, financial institutions are transitioning to commission-based income from businesses such as payments and technology businesses.

The elevated credit risk to corporate and retail clients of banks is one of the immediate consequences of the health emergency on the actual global economy. Banks must differentiate between strictly temporary phenomena that can be absorbed in a short period and longer-term impacts that will necessitate management and reclassification efforts in order to continue funding the actual economy and help its recovery.

The following are the most important factors to consider:

- Given the unique existence of COVID-19, the forward-looking information update — in particular, the manner in which new information must be translated into risk parameters — must be closely examined. This might last less time than cyclical downturns brought about by economic or financial factors;

- The updating of the ‘default rates,’ which would account for any exemptions issued by authorities in relation to only temporary phenomena of creditworthiness expiration;

- the determination of the most suitable timescales for adjusting the ‘recovery rates’ in order to account for the beneficial consequences resulting from credit recovery policies that might include delayed payments or agreements on longer maturities (restructuring debt, etc.), though eventually in the medium term;

As the economy declines, banks are rising loan loss guarantees, which has a negative impact on credit quality. A few European banks have already recorded substantial losses in Q1’20 (Jan-Mar), indicating that they are bracing for an increase in bad loans.

The landscape of securitization

Governments’ disciplinary actions tend to reduce risk profiles by including more incentives for disposals.

- Along with recent trends and the potential economic consequences, it is likely that the future demand for synthetic securitizations will need revitalization.

- Several European banks have completed substantial distressed loan disposition operations in recent years, resulting in a significant decline in the NPL ratio. The intense interest in unlikely-to-pay (UTP) loans, the birth of a fervent secondary market for bad debts, and the amalgamation of homogeneous large-ticket asset groups in the creation of portfolios planned for the market, i.e., so-called single names, are among the market’s influential evolutionary phenomena.

Commercial and customer engagement models

- While COVID-19 trigger a real-economy crisis, its effect on the banking system and the bank-customer relationship can be viewed as a “positive discontinuity” in terms of the sector’s digitization and capacity to provide excellent customer service.

- Also, the most territorial and branch-centric banks are being pushed to promote the use of networks that were never a strategic target for them. This is an especially difficult process, which banks must overcome by showing genuine proximity to their customers.

- Banking operators’ strong awareness of their service gap, which has become more concrete than ever before thanks to COVID-19, may encourage them to accelerate their digital transformation journey through alliances and collaborations with the fintech group.

Management of operational resilience and market sustainability

- The activation and enhancement of robotics solutions or artificial intelligence (e.g., Advanced BOTs that support the processes of adoption of the technologies shown on the direct channels) and mobility (e.g., platforms for the management of promoters and systems authorizations) will play an important role in ensuring the banks’ business continuity.

- With the need for unpredictably available infrastructure resources, there is a compelling incentive for the financial industry to assess the advantages of Cloud technology.

Stock market uncertainty has lowered bank valuations

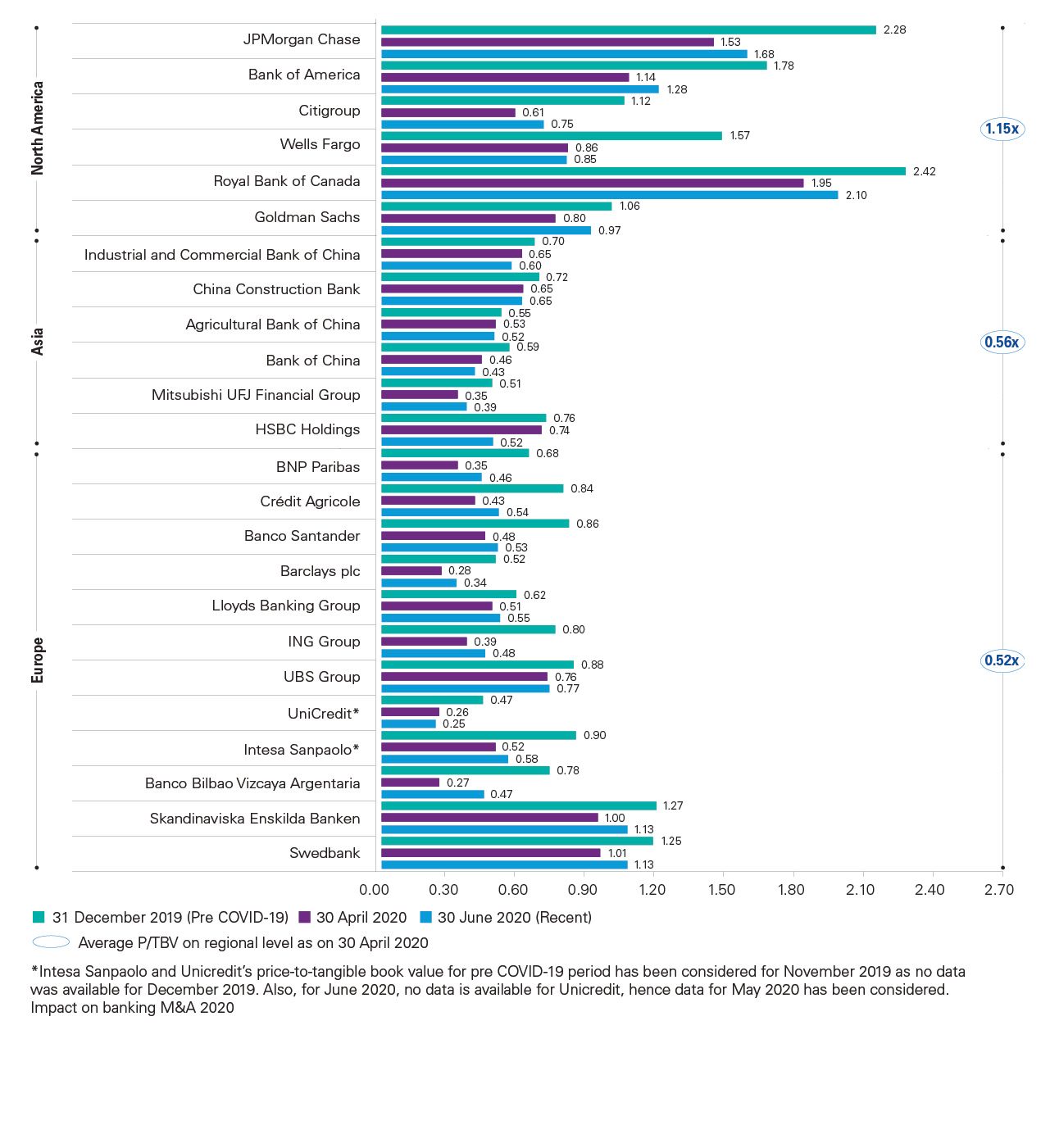

COVID-19 has wreaked havoc on global financial markets, causing major uncertainty and high volatility. The banking sector has been particularly hard hit, with bank valuations falling in all countries around the world (the P/NAV multiple fell from 1.00x on December 31, 2019, to 0.69x on April 30, 2020). North American banks continue to trade at an average P/NAV of 1.15x, while Asian and European banks (with the exception of the Nordics) are actually trading at significant discounts (average P/NAV of 0.56x and 0.52x, respectively).

During COVID-19, banking stocks were affected. Most banks experienced a price drop in mid-March during the period from 01 December 2019 to 30 April 2020. The Euro STOXX banks index fell 40.18 per cent during the time, led by the STOXX North America 600 banks index (31.23 per cent) and the STOXX Asia/Pacific 600 Banks Index (26.09 per cent).

While maintaining a strong connection to profitability

The regression analysis predicts a strong relationship between bank valuation and profitability. North American banks, in particular, are seeing higher valuations due to higher profitability, which is mostly influenced by diversification in market operations (e.g. investment banking services), with RONAV of 11.4 per cent on average, compared to 10.9 per cent and 7.5 per cent for Asian and European banks, respectively. At a regional basis, assuming a RONAV of 10%, the inferred P/RONAV in North America, Europe, and Asia, respectively, is 1.0x, 0.8x, and 0.5x.

What are the long-term implications of the crisis?

While it is too early to make definitive forecasts regarding the long-term impact of the Covid-19 crisis on the banking system, certain patterns are already apparent:

For instance, low-interest rates, which are near to zero or even negative, are here to last for the far future. This will undoubtedly bring more strain on bank profits.

Second, the movement toward digitization could accelerate even further, as social distancing becomes the norm, and personal transactions between banks and clients become even more expensive. This may mean more branches closing and a greater emphasis on phone and internet banking.

Third, the recession would exacerbate competition for banks from ‘fintech’ (financial technology companies), especially Big Tech companies like Alibaba or Tencent in China, and Facebook, Google, Apple, and Amazon in the West. These major web players are expected to emerge stronger from the recession, with a large cash pile and a strong role (and potentially a strong appetite) to grow into financial services. This might bring banks under even more competitive pressure in their main business lines.

These three patterns began before the pandemic, although they may become more prominent as a result of the crisis. As a result, we will see increased competitive strains on banks, requiring a creative response on their part.